H2 for Europe

Hydrogen vision for Europe

Renewable and low carbon hydrogen will play a key role in the energy transition of Europe

To achieve the target of net zero emissions by 2050 the EU makes hydrogen a key element in its European hydrogen strategy. The role of hydrogen is further emphasized by the REPowerEU plan, established by the European Commission (EC) in 2022. The plan targets 10 Mt (333 TWh) of domestic renewable hydrogen production, as well as up to 10 Mt on hydrogen (carrier) imports by 2030.

Achieving the REPowerEU targets by 2030 and a fully decarbonised European energy system at the latest by 2050 is ambitious. It will require a rapid deployment of domestic hydrogen production capacities, hydrogen storage and import infrastructure as well as a pan-European hydrogen transmission network.

Renewable and low carbon hydrogen has received growing attention in Europe and around the world. Hydrogen can be used both as a feedstock and fuel. It is storable and has many possible applications across the industry, transport, power, and buildings sectors.

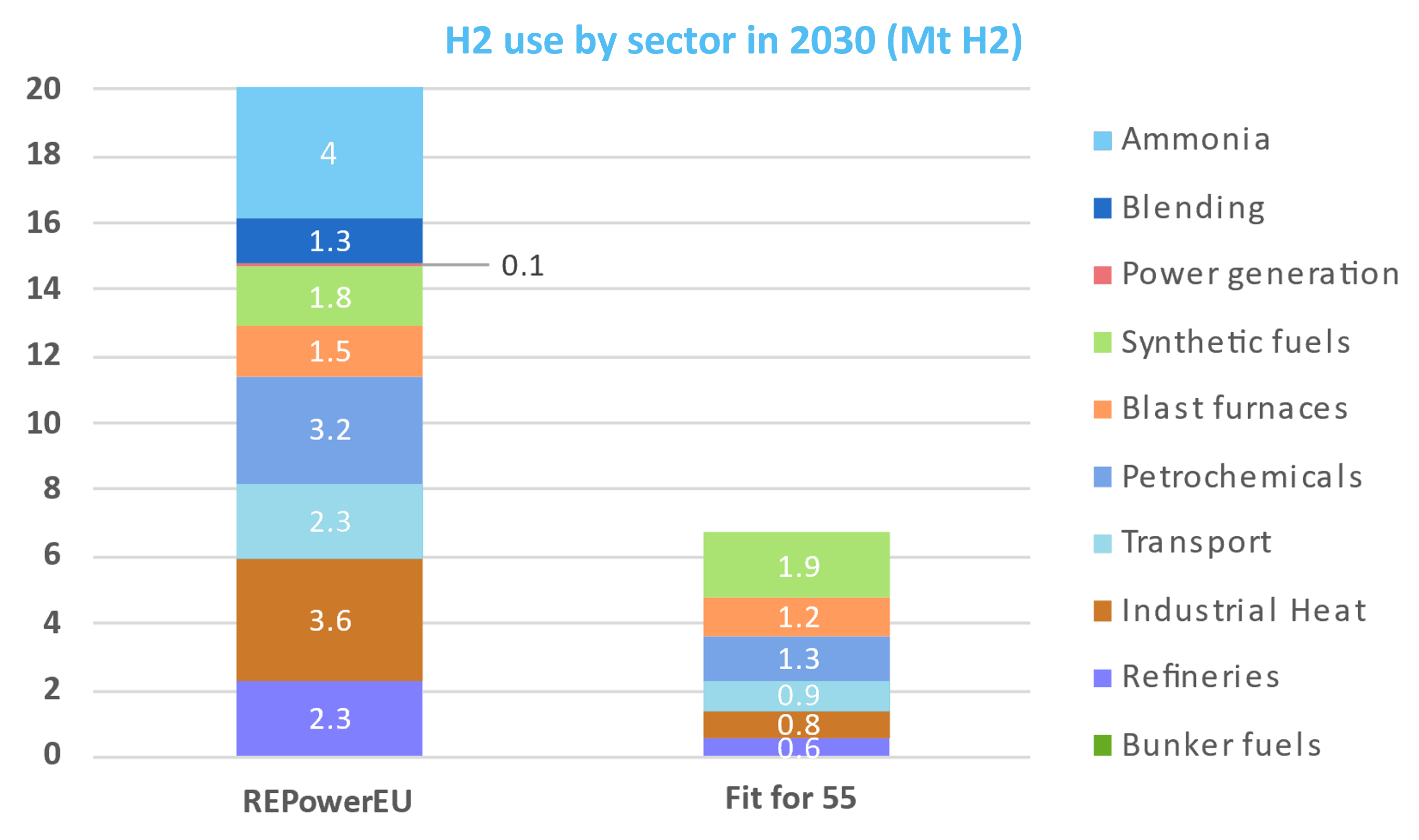

H2 use by sector in 2030 ( Mt H2)

Source: European Commission

Hydrogen does not emit CO2 at the point of use and can be produced with a very low GHG emission footprint (renewable or low carbon hydrogen). Thus, it offers a solution to decarbonise industrial processes and economic sectors where reducing carbon emissions is both urgent and hard to achieve.

We believe the CGHI initiative will significantly contribute to achieving this vision of a climate neutral Europe in 2050.

Hydrogen transport

European Hydrogen Backbone: Vision for a pan-European hydrogen transport infrastructure

Europe’s regions have different hydrogen supply and demand potentials, which require connecting regions across Europe. That is why the European Hydrogen Backbone (EHB) initiative was created in 2020. A group of currently thirty-one energy infrastructure operators (including OGE, N4G and GASCADE) presented a shared vision of a climate-neutral Europe enabled by a thriving renewable and low-carbon hydrogen market.

The EHB mission is to accelerate Europe’s decarbonization journey. Hydrogen infrastructure, based on existing and new pipelines, will play a critical role in enabling the development of a competitive, liquid, pan-European renewable and low-carbon hydrogen market.

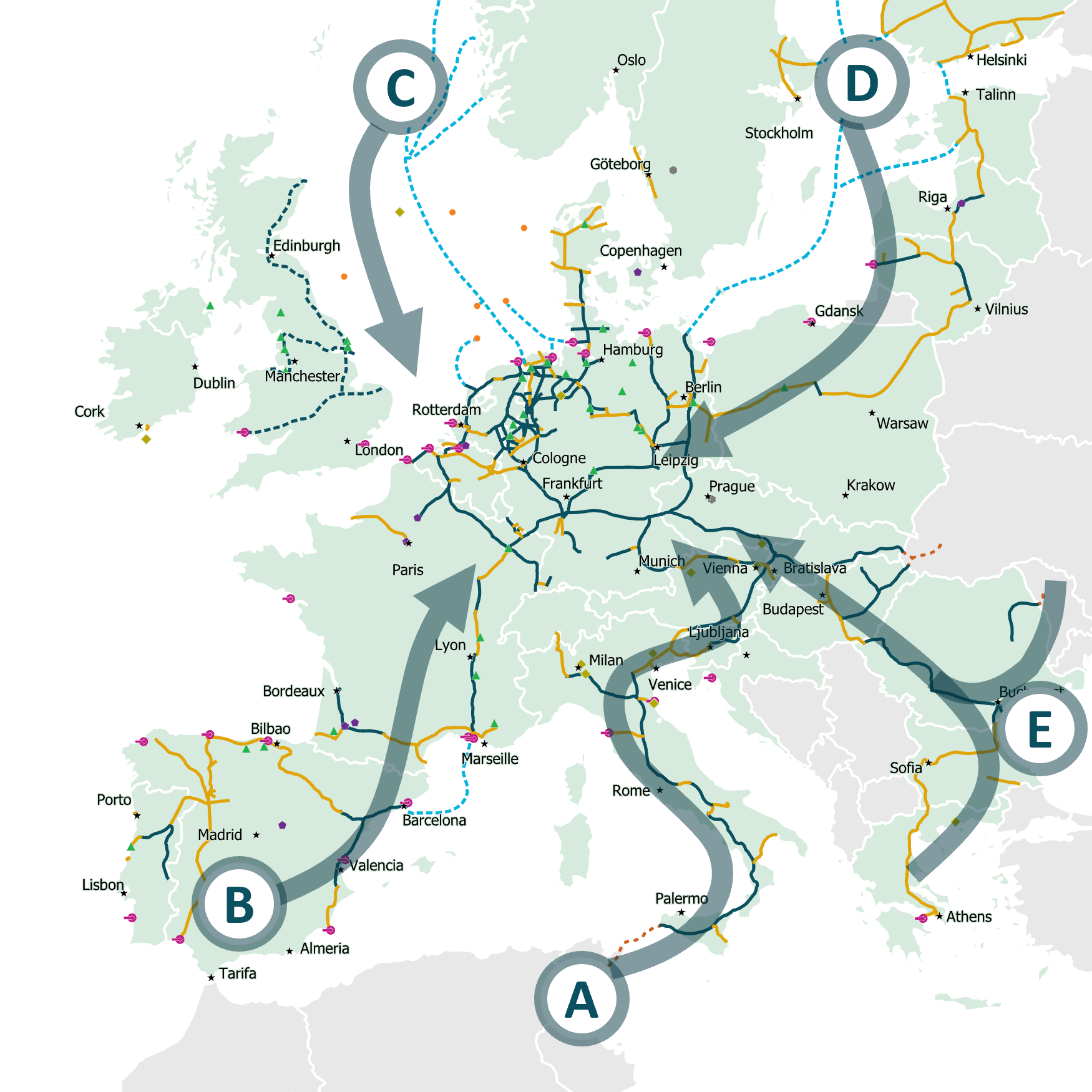

In its latest report in 2022, EHB presented a visionary hydrogen pipeline infrastructure of 28,000 km in 2030 and 53,000 km in 2040.

Five pipeline corridors span both domestic and import supply markets to achieve the accelerated targets set by the REPowerEU plan. These five corridors are in line with the import corridors identified in the recent REPowerEU roadmap. The CEHC initiative is an essential part of the Corridor E: East and South-East Europe.

To deliver the 2030 hydrogen demand targets set by the REPowerEU plan, five large-scale pipeline corridors are envisaged.

- Each corridor plays a pivotal role connecting regions of abundant and low-cost hydrogen supply with regions of high demand.

- The corridors also connect Europe with neighboring regions with significant export potential.

The five hydrogen supply corridors are:

- Corridor A: North Africa & Southern Europe

- Corridor B: Southwest Europe & North Africa

- Corridor C: North Sea

- Corridor D: Nordic and Baltic regions

- Corridor E: East and South-East Europe

Cost-effective option for large scale long distance hydrogen transport

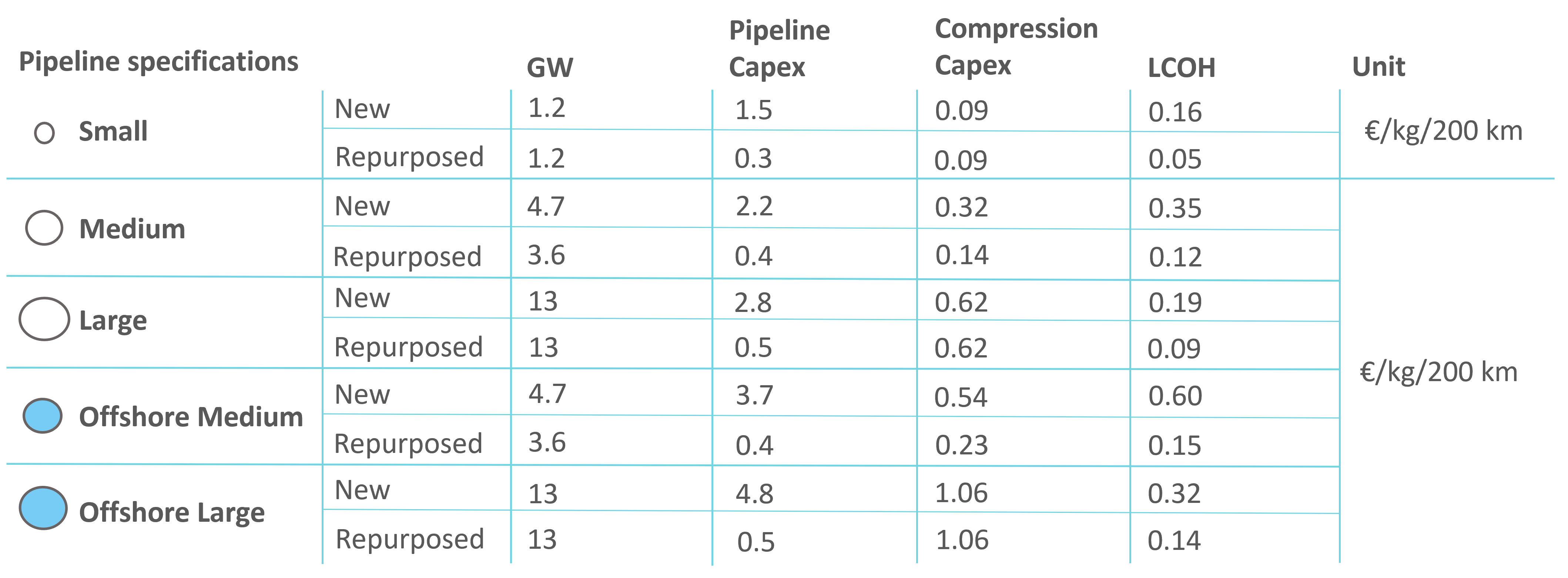

The proposed European Hydrogen Backbone for 2040 envisages using 60% of repurposed natural gas pipelines and 40% new pipeline stretches. Investment costs in repurposed natural gas pipelines are approx. 20% of newly built hydrogen pipelines (see table below).

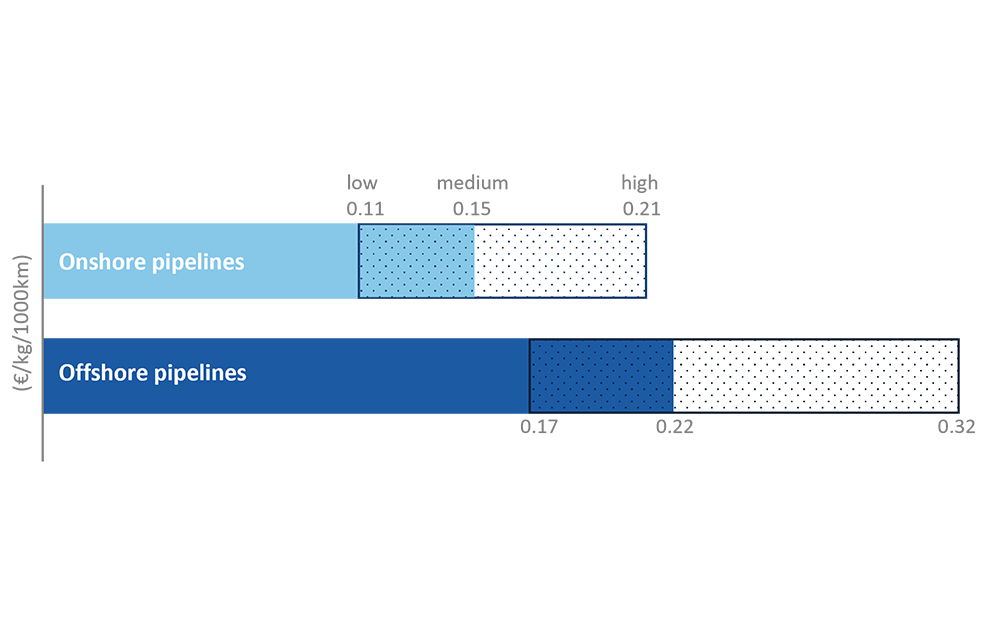

Overview of unit capital costs and estimated costs of pipeline transport for different pipeline types in the medium scenario

Source: ehb.eu

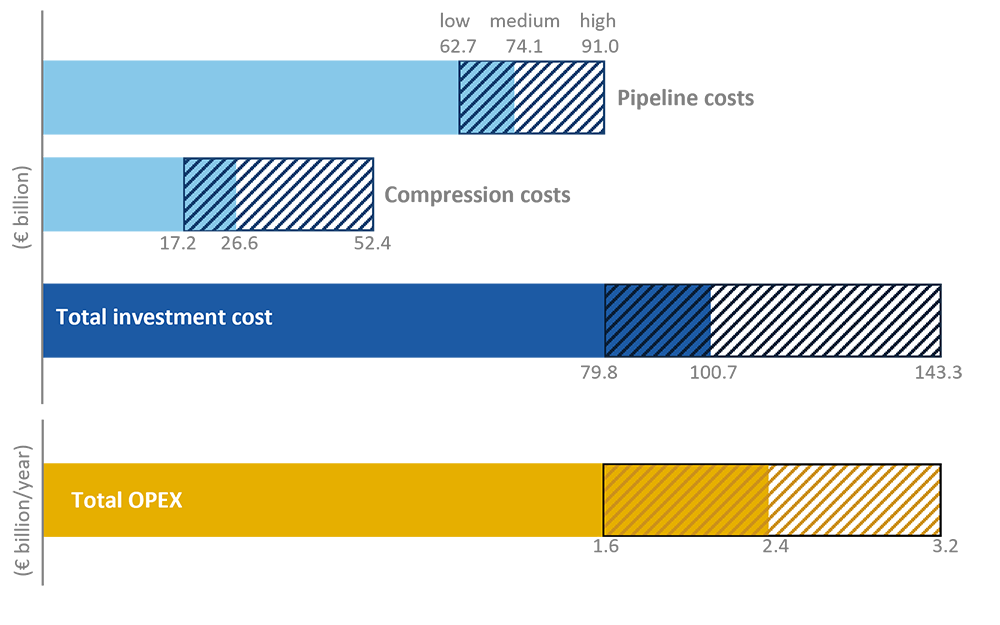

Using repurposed pipelines therefore significantly drives down the required cost for building the network. For a European Hydrogen Backbone of total length of 53,000 km in 2040 this is leading to an estimated total investment of €80-143 billion, which is relatively limited in the overall context of the European energy transition.

The levelized costs of transport are translating CAPEX and OPEX into hydrogen transportation costs. Transporting hydrogen over 1,000 km along the proposed onshore backbone would on average cost €0.11-0.21 per kg of hydrogen, making the EHB the most cost-effective option for large-scale, long-distance hydrogen transport. In case hydrogen is transported exclusively via subsea pipelines, the cost would be €0.17-0.32 per kg of hydrogen per 1,000 km transported.